Bitcoin prices fell sharply on Tuesday. This drop came after Iran launched missiles at Israel. The attack raised fears of a wider conflict in the Middle East. Ethereum and Dogecoin also saw big price drops.

Also Read: Shiba Inu: AI Predicts SHIB’s Price For The Weekend

War Fears Shake Cryptocurrency Market: Bitcoin, Ethereum, Dogecoin Under Pressure

Bitcoin And Other Major Cryptocurrencies Tumble

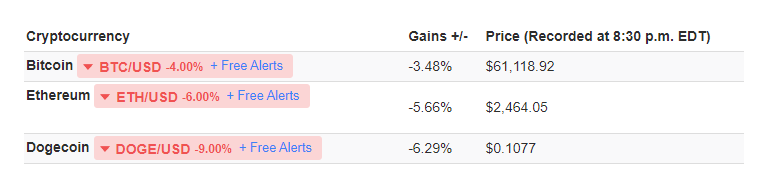

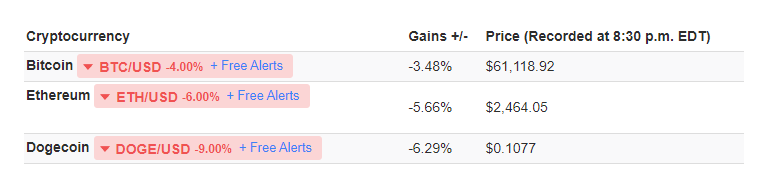

Bitcoin’s price fell 3.48% to $61,118.92. It hit a two-week low of $60,370 before recovering slightly. Ethereum dropped even more, falling 5.66% to $2,464.05. This was its lowest price since August 19. Dogecoin suffered the most, with a 6.29% drop to $0.1077.

The total value of all cryptocurrencies fell by 4.16% in one day. It now stands at $2.14 trillion. Stock markets also went down during this time.

Big Losses for Traders

Many traders lost money in this market crash. Over $521 million in crypto positions were closed in 24 hours. This was the biggest loss since a major crash last August. About $450 million in bets on rising prices were wiped out.

Also Read: Bitwise Files for a Spot Ripple XRP ETF

Fear Takes Over the Market

The Crypto Fear & Greed Index showed high fear levels. This means many investors were selling in a panic. The futures market also showed this fear. There was less money in Bitcoin and Ethereum futures contracts.

Expert Bitcoin Trader’s Warning

Peter Brandt, a well-known trader, shared his thoughts on Bitcoin’s recent price moves.

Brandt said, “Bitcoin’s recent rise didn’t change its downward trend of the last 7 months.” He added that Bitcoin needs to close above $71,000 and hit a new all-time high to reverse this trend.

Claims of Market Manipulation

MartyParty, a crypto commentator, thinks big investors are manipulating the market. He believes they’re using the war fears to their advantage.

He explained: “Big players sell lots of crypto. This causes panic and prices drop. Small investors sell in fear. Then the big players buy back at lower prices.” He warned people not to fall for this trick.

Some Coins Buck the Trend

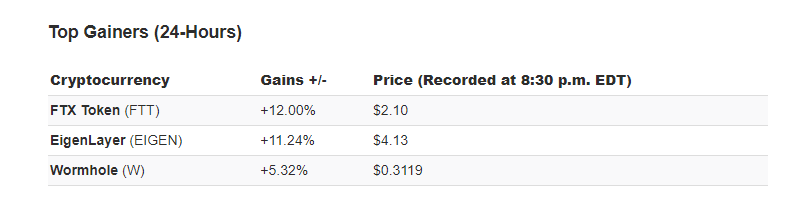

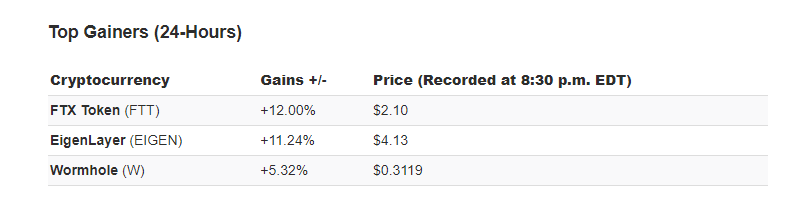

Not all cryptocurrencies lost value. FTX Token (FTT) actually went up by 12.00%. EigenLayer (EIGEN) rose by 11.24%, and Wormhole (W) increased by 5.32%.

Also Read: Shiba Inu: What’s Blocking SHIB From Reaching New All-Time High?

These gains show that crypto markets can be unpredictable, even when most prices are falling.