- An analyst predicted that a hike above the resistance would spark a 300% rally for ALGO

- Metrics suggested that there were chances of a correction in the short term

Algorand [ALGO] recently breached a bullish pattern on the charts, allowing it to register significant gains. In fact, at the time of writing, the token seemed to be approaching a descending trendline.

A breakout above the same could result in a 300% hike over the coming months.

Is Algorand ready for a double breakout?

World of Charts, a popular crypto analyst, shared a tweet a few days ago regarding ALGO’s breakout above a bullish falling wedge pattern. Since the breakout, the token has been running at 50% profits. To put it into perspective, Algorand’s price has risen by over 32% in the last seven days.

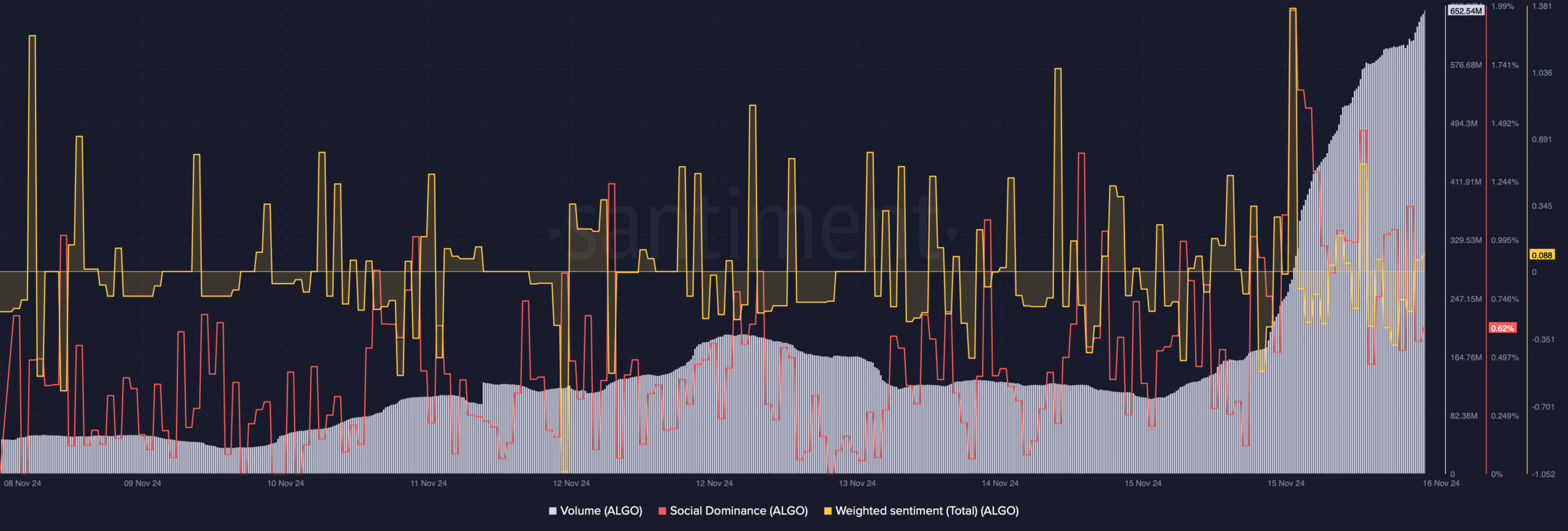

Thanks to ALGO’s latest bout of price appreciation, the altcoin’s social dominance surged – A sign of its growing popularity.

The token also saw a spike in weighted sentiment, indicating rising bullish sentiment. Additionally, the altcoin’s price hike was supported by a significant uptick in trading volume too.

ALGO’s latest price action pushed it towards another resistance level. According to a tweet from World Of Charts, if a successful breakout occurs, ALGO could see a 300% price rise in the coming months.

While the 300% hike is a long-term goal and appears unrealistic in the short term, AMBCrypto still assessed the token’s on-chain data.

Odds of a bullish breakout

Coinglass data revealed that ALGO’s Open Interest (OI) increased sharply. Now, while this might seem bullish at first glance, the reality might be something different altogether.

Historically, whenever ALGO’s OI has hit its press time level, it has been followed by price corrections. A similar episode happened back in April, when ALGO’s price dropped to $0.17 after its OI spiked.

At the time of writing, Algorand’s fear and greed index had a value of 71, meaning that the market was in a “greed” phase. The chances of a price correction always climb when the market sentiment turns greedy.

On the price charts, ALGO’s price well surpassed the upper limit of the Bollinger Bands, indicating a possible price correction. If that happens, ALGO might drop to $0.18 once again.

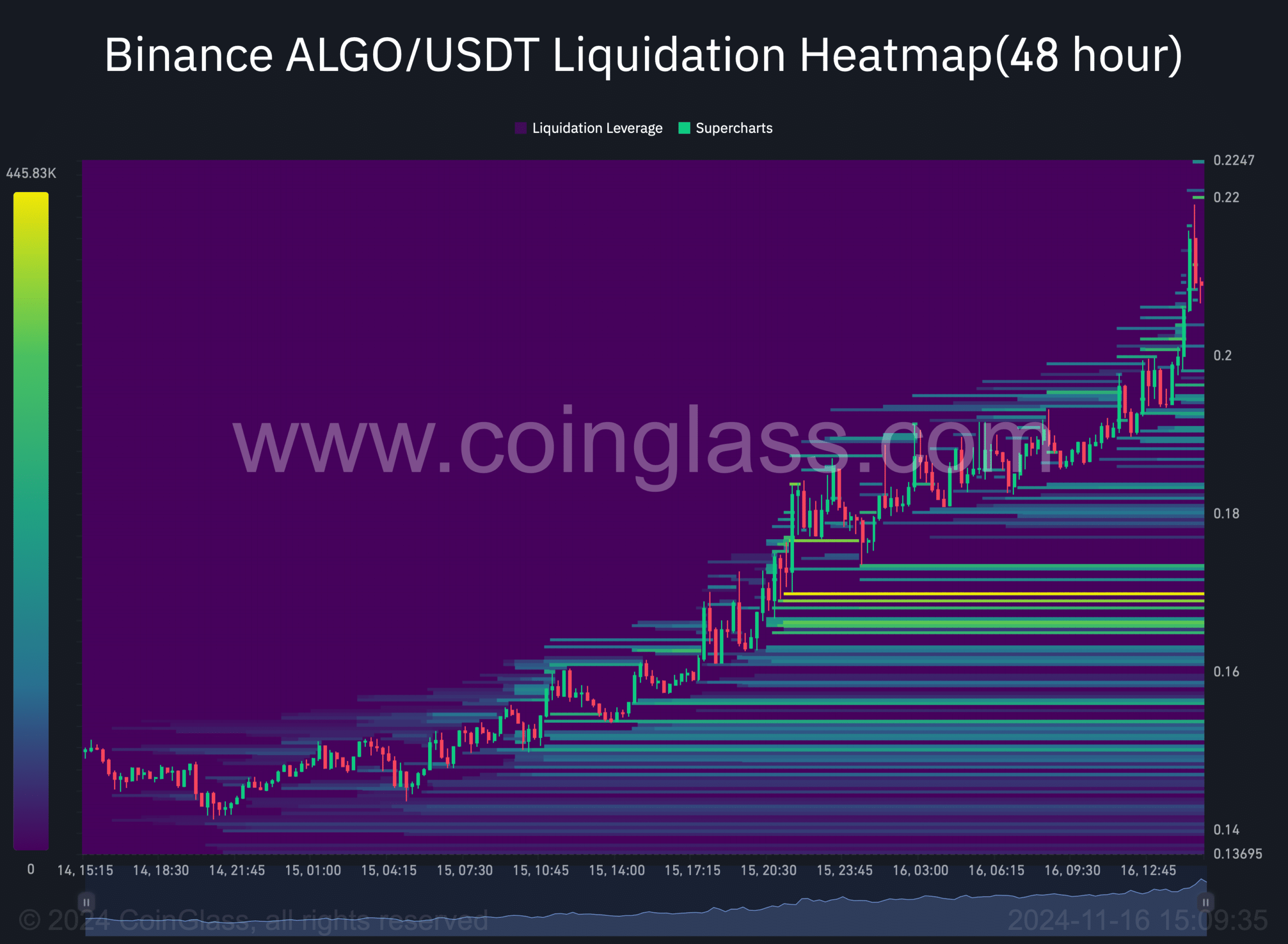

The altcoin’s liquidation heatmap also revealed a similar possibility. At the time of writing, the token had a strong liquidation floor near $0.16-$0.18.

In case of a price drop, ALGO will have a chance to regain bullish momentum from that range.

Is your portfolio green? Check out the Algorand Profit Calculator

However, if the bulls continue to push harder, then expecting the token to touch $0.3 by the end of November won’t be too unrealistic.