- Crowd and smart money sentiment both highlighted market optimism

- Higher transaction counts and active addresses, combined with declining exchange reserves, supported XRP’s bullish chances

XRP’s market sentiment, at press time, projected a strong bullish outlook, with crowd sentiment scoring a positive 1.77 and smart money sentiment at 0.76. This alignment between retail and institutional investors, together, could be a sign of growing confidence across the board.

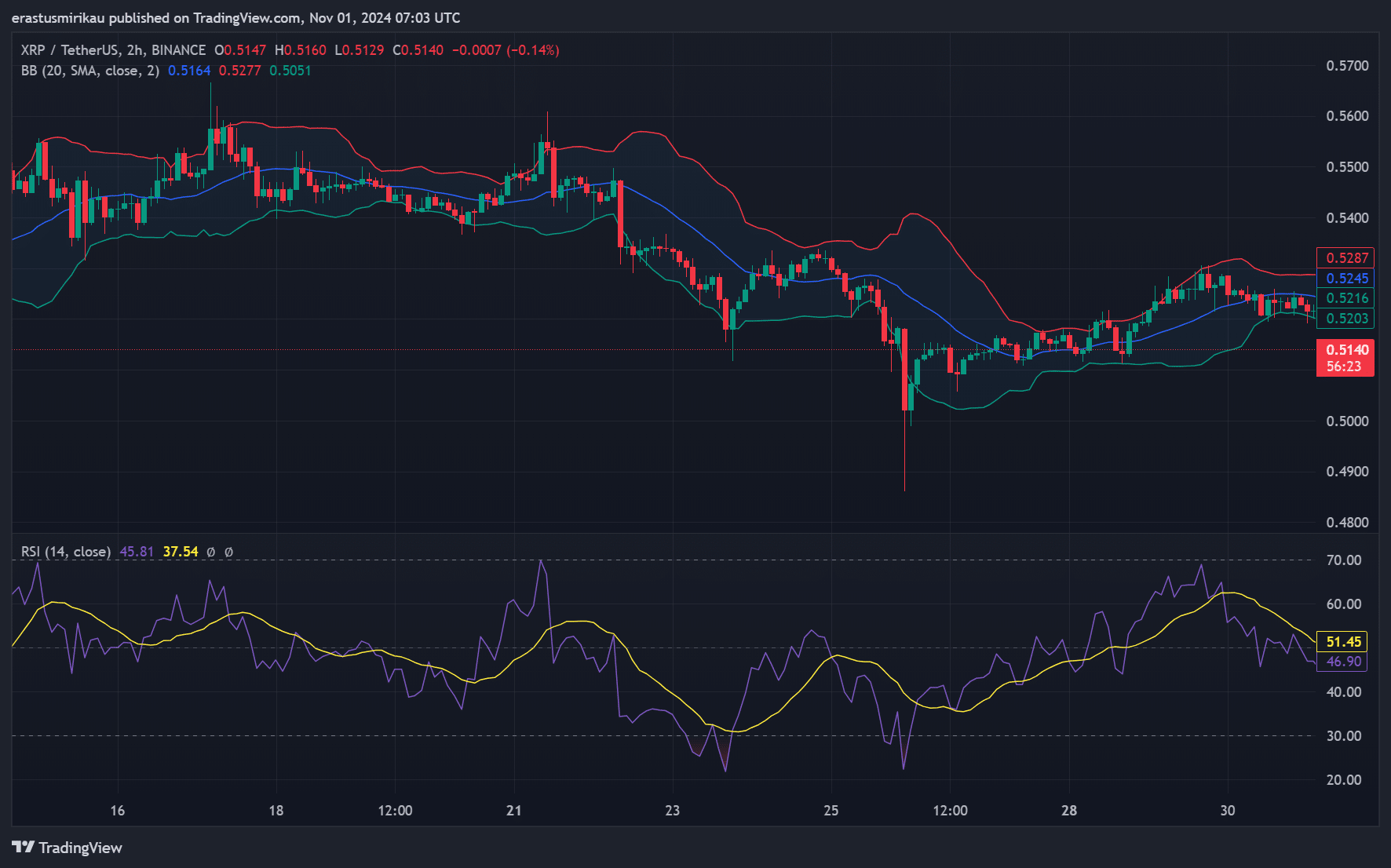

At the time of writing, XRP was trading at $0.514, marking a minor dip of 0.14% over the last 24 hours. However, the larger market sentiment indicated some potential for upward momentum. Hence, the question – Could this dual bullish sentiment be the spark for XRP’s next rally?

Price action overview – Can XRP break free from its range?

When examining its recent price movements, the token seemed to be consolidating within a narrow range, oscillating between $0.51 and $0.52. In fact, Bollinger Bands’ data showed a contraction, suggesting reduced volatility in the short term.

Nevertheless, the Relative Strength Index (RSI) sat near 45.81, indicating that XRP could be nearing oversold levels. Consequently, this set-up could pave the way for a breakout if buying pressure climbs in line with the prevailing positive sentiment.

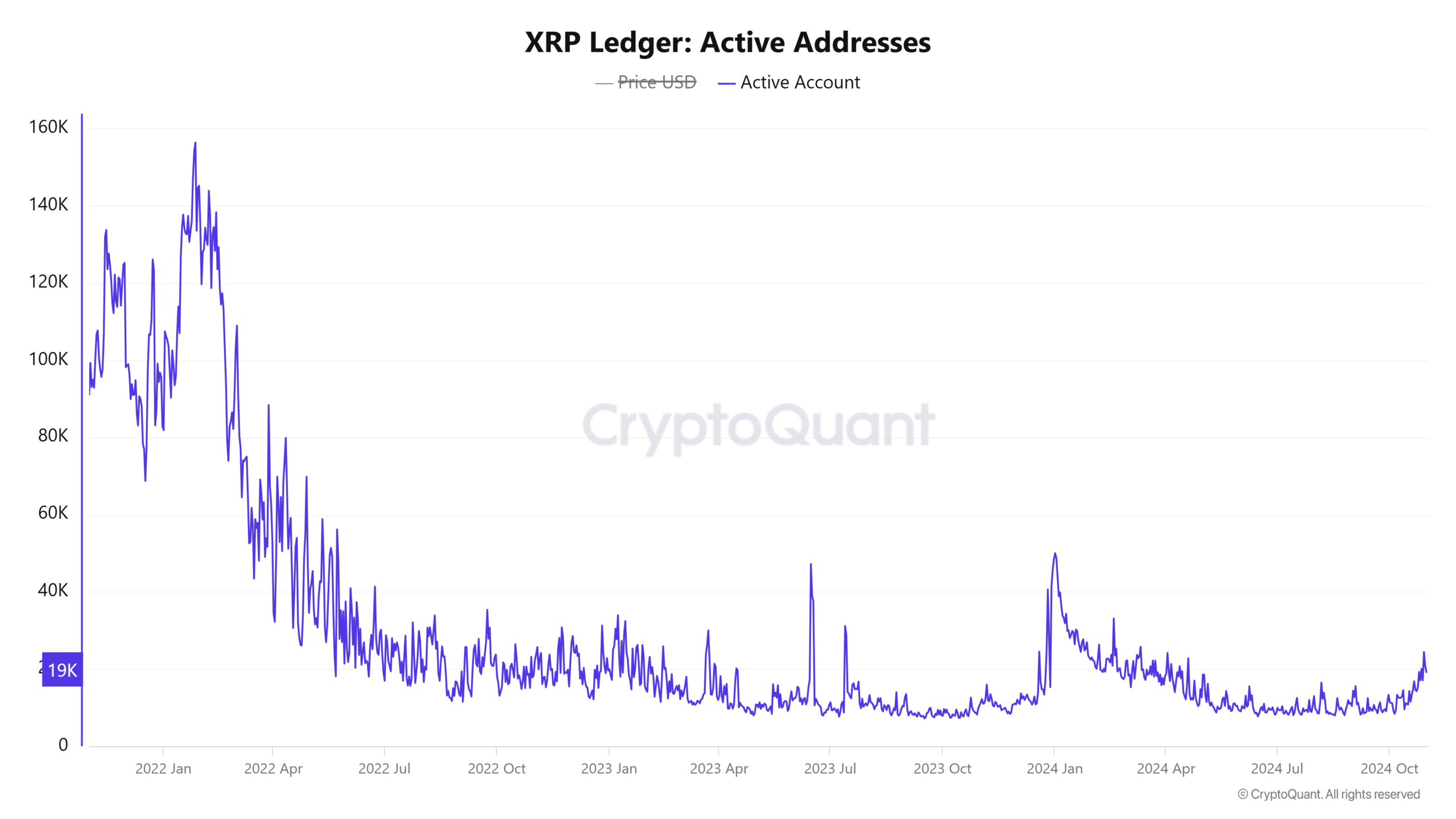

XRP active addresses surge – Bullish network signal?

Additionally, the network strength appears to be gaining traction too. The active address count has risen by 0.92% in the last 24 hours, totaling 19.191k unique addresses. This hike in active addresses can be interpreted to be a sign of heightened user engagement on the XRP ledger.

Generally, more active addresses indicate growing interest from users, often a precursor to stronger transaction volumes.

Therefore, the boost in active addresses is a sign of rising demand – A development that aligns well with the broader bullish sentiment surrounding XRP.

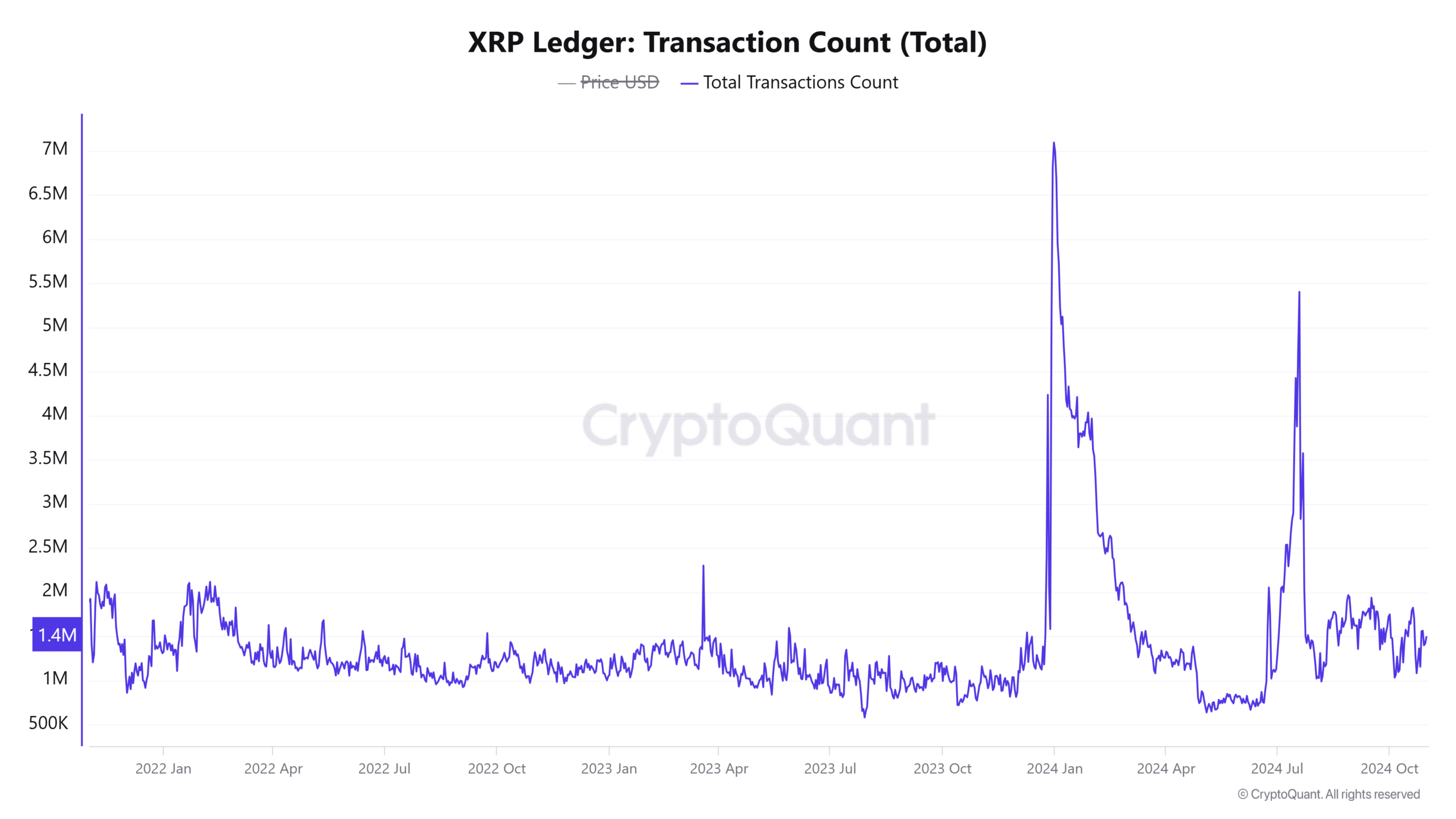

XRP transaction count growth – Higher network utility

The surge in transaction count further highlighted XRP’s expanding utility.

The total transaction count grew by 0.98% over the last 24 hours, hitting 1.4089 million. A hike in transaction activity on the network often leads to stronger demand for the token – A positive signal for price stability and potential growth.

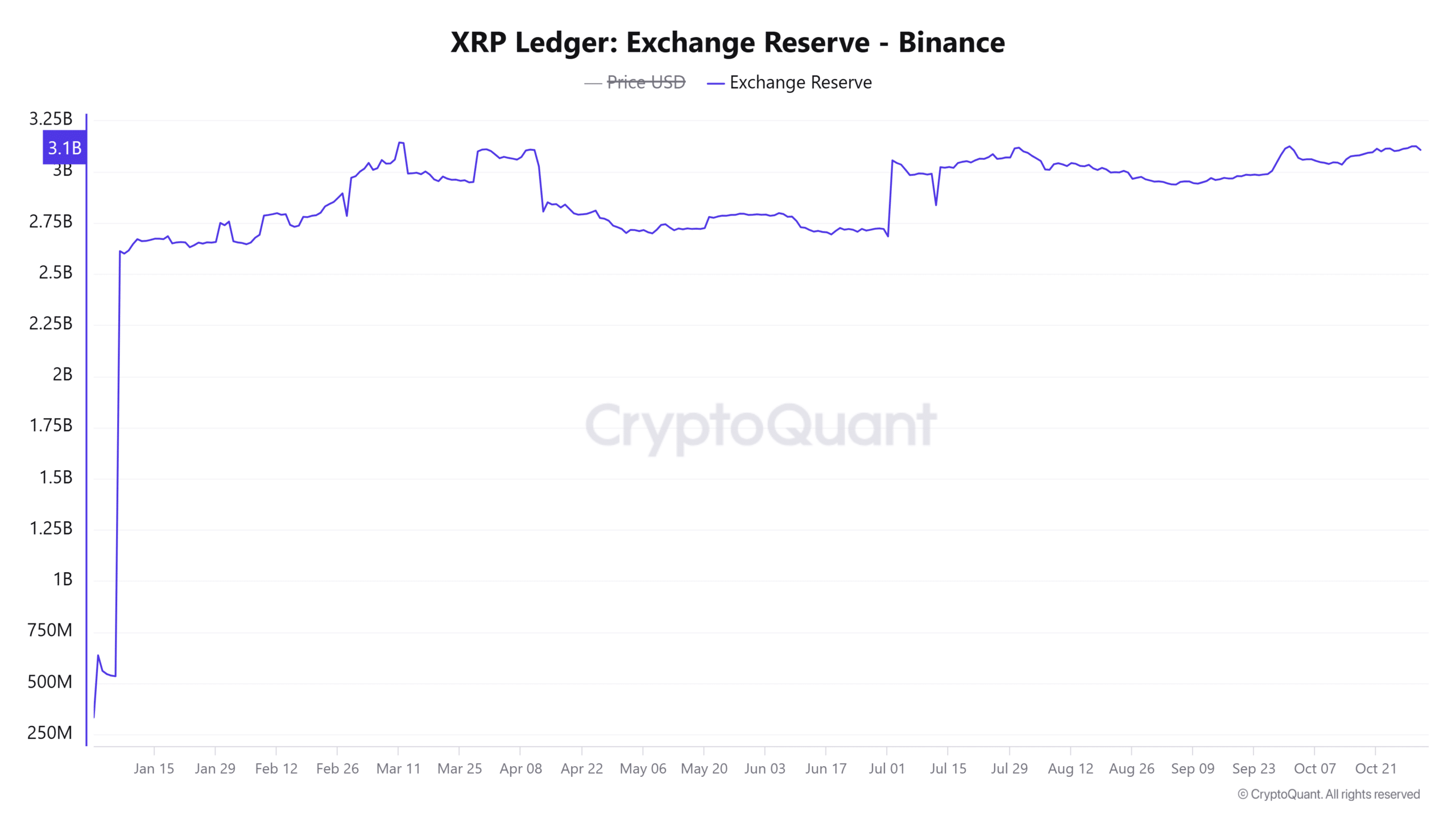

Exchange reserves fall – Lower selling pressure ahead?

In another positive development, the exchange reserves decreased by 0.59% in the past 24 hours. Generally, a drop in exchange reserves implies lower potential selling pressure, as fewer tokens are held on exchanges for immediate sale.

Investors withdrawing XRP from exchanges may signal confidence in the asset’s long-term prospects. Therefore, this reduction in reserves complements the bullish market sentiment, suggesting that selling pressure could remain limited in the short term.

Read Ripple’s [XRP] Price Prediction 2024-25

Conclusively, the indicators collectively underlined a strong foundation for potential upward movement. Both crowd and smart money sentiment were bullish, while on-chain metrics like active addresses and transaction counts seemed to exhibit positive growth.